Johan Hombert

Professor of Finance, HEC Paris

Director of the HEC Paris PhD Program

Email: hombert@hec.fr

Submit a paper to the HEC Paris Entrepreneurship Workshop, which will be held on December 11-12, 2025, at HEC Paris.

Working Papers

Innovation Booms, Easy Financing, and Human Capital Accumulation with Adrien Matray

Revise & Resubmit Journal of Financial Economics

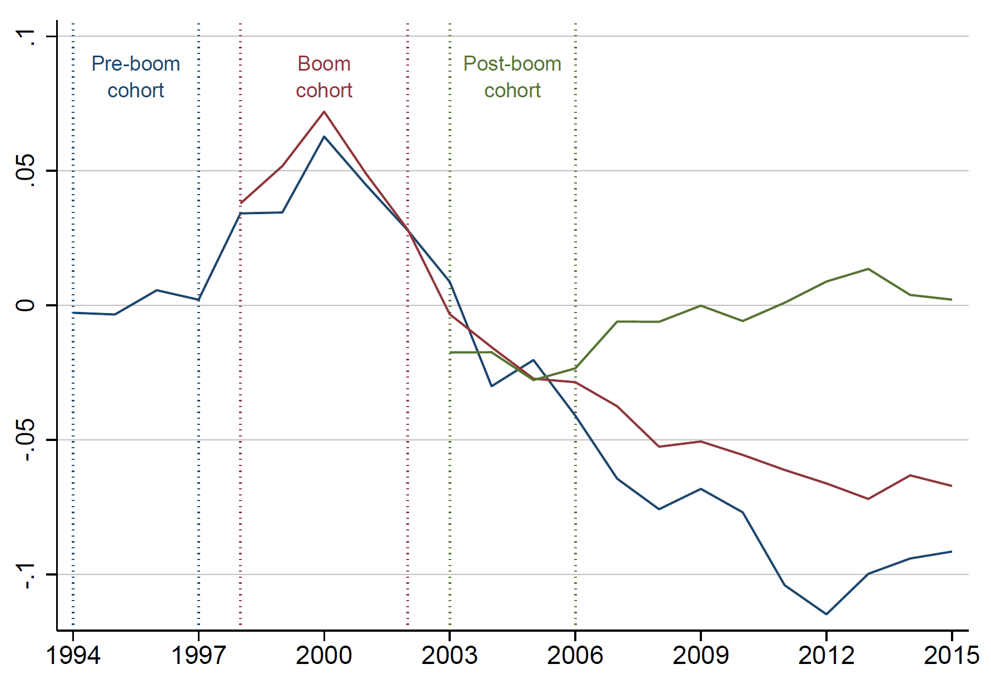

The figure shows the earnings premium of ICT workers relative to non-ICT workers. Each color is a different cohort of workers. ICT workers who started during the late 1990s technology boom initially enjoyed an earnings premium, which turned into a discount fifteen years out.

Cap and Trade with Imperfect Hedging with Bruno Biais, Daniel Schmidt, and Pierre-Olivier Weill

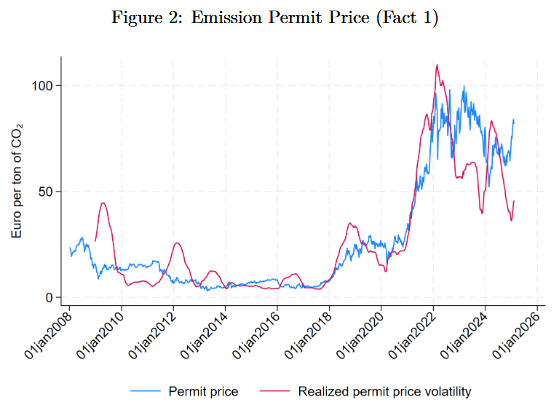

The price of emission permits in the EU has been volatile, especially since the 2018 with increasing uncertainty about climate policies.

The Real Effects of Valuation Mistakes: Estimates from Mergers and Acquisitions with François Derrien, Alexei Ovchinnikov, and Philip Valta

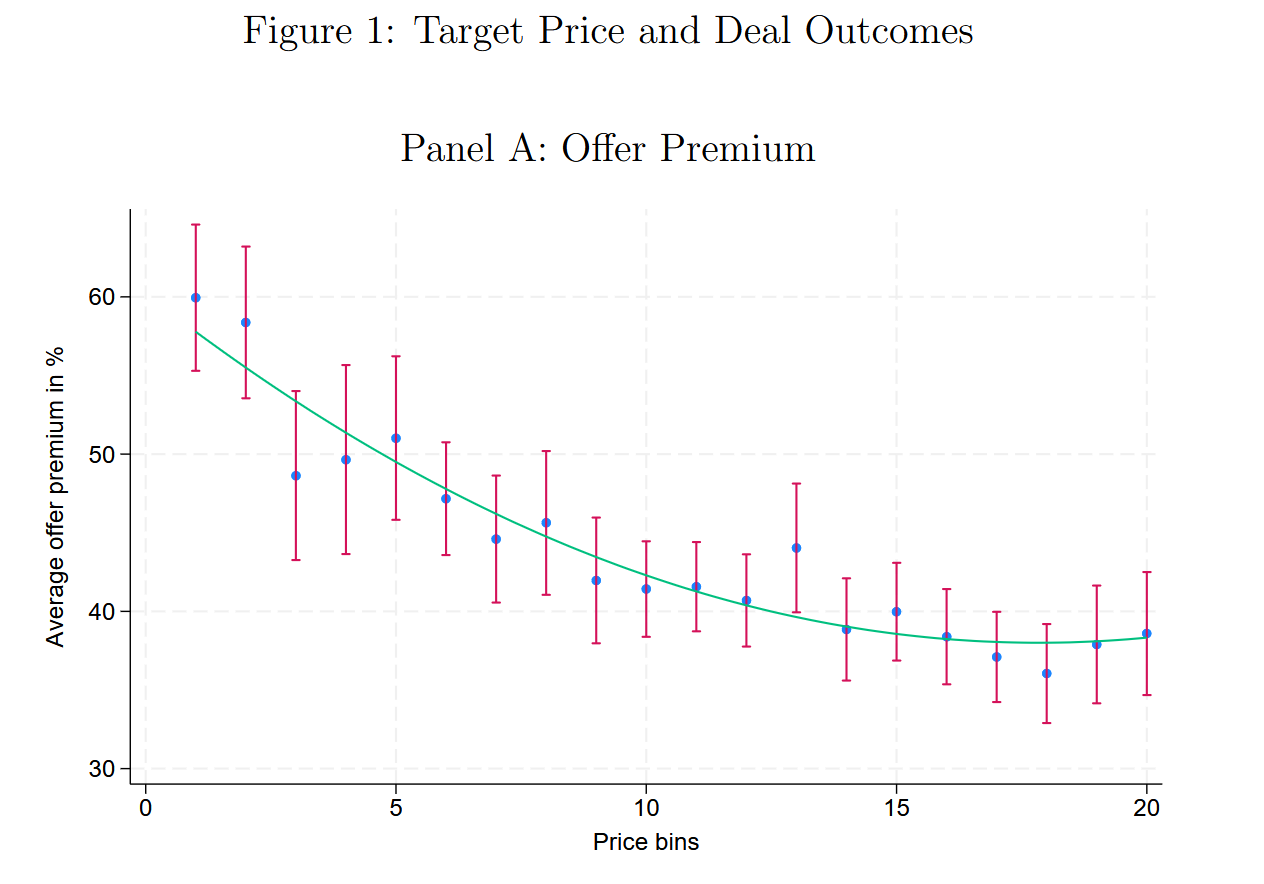

The figure displays the average merger premium across bins of the target's pre-offer stock price. Investors subject to non-proportional thinking ask (too) high merger premia to sell low-price targets and offer (too) low merger premia to buy high-price targets.

Contract Completeness of Company Bylaws and Entrepreneurial Success with Paul Beaumont and Adrien Matray

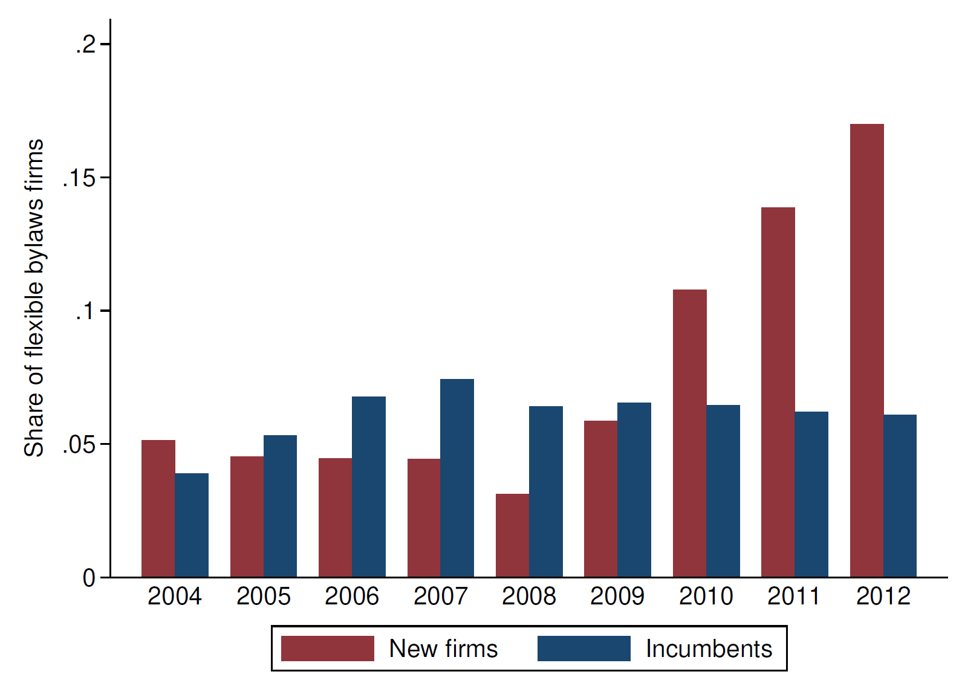

Until the 2008 reform, less than 5% of new firms opted for the corporate legal form that allows firms to write complex bylaws. This share increased above 15% after the reform. We show that, by allowing entrepreneurs to write more complete contracts with investors, the reform fostered entrepreneurial success.

[Draft coming soon]

Inter-Cohort Risk Sharing with Long-Term Guarantees: Evidence from German Participating Contracts with Axel Möhlmann and Matthias Weiss

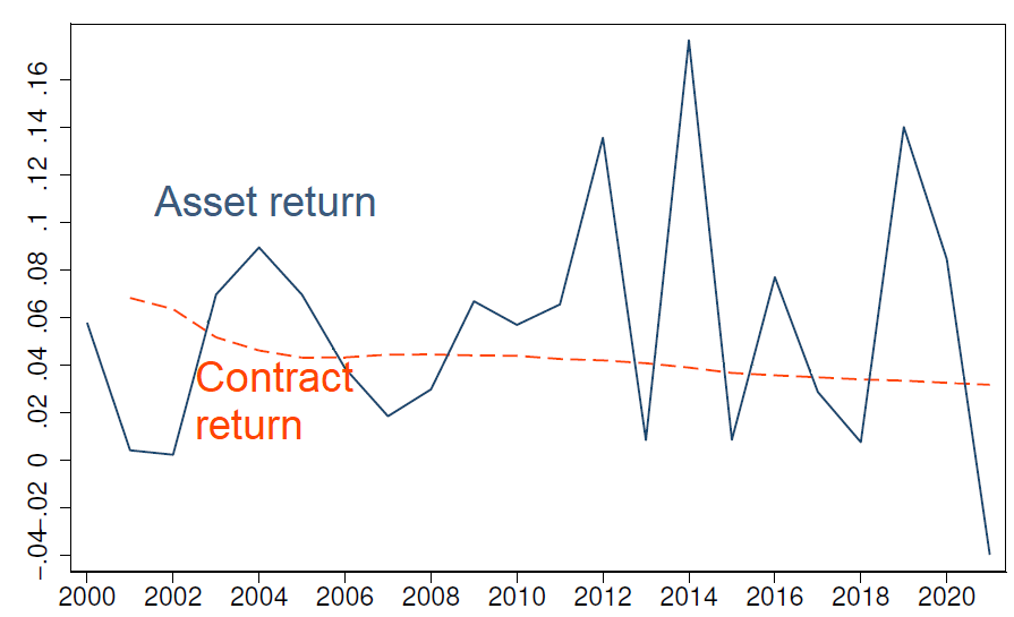

Life insurers use reserves to absorb shocks to the return on assets held (blue) and smooth the return paid to their customers (orange). This smoothing mechanism generates risk sharing between cohorts of investors.

Publications

Can Risk be Shared Across Investor Cohorts? Evidence from a Popular Savings Product

with Victor Lyonnet

Review of Financial Studies, 2022

Private implementation of inter-cohort risk sharing on a large scale: savings products sold by life insurers in France transfer 0.8% of GDP across cohorts of investors every year.

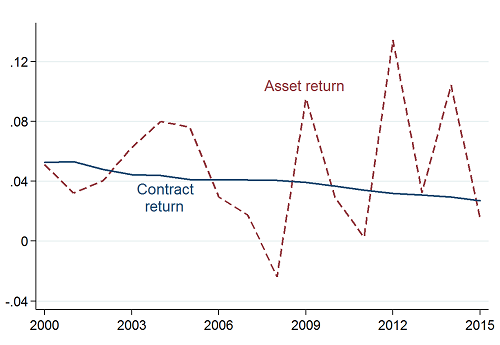

Life insurers use reserves to absorb shocks to the return on assets held (red) and smooth the return paid to their customers (blue). This smoothing mechanism generates risk sharing between cohorts of investors.

Incentive Constrained Risk Sharing, Segmentation, and Asset Pricing

with Bruno Biais and Pierre-Olivier Weill

American Economic Review, 2021

When imperfect asset pledgeability creates endogenous borrowing constraints, asset markets are endogenously segmented, assets trade at a discount relative to replicating portfolios of derivatives, and expected excess returns are concave in beta.

Can Unemployment Insurance Spur Entrepreneurial Activity? Evidence from France

with Antoinette Schoar, David Sraer and David Thesmar

Journal of Finance, 2020

Giving unemployment benefits to entrepreneurs leads to the entry of small firms which eventually grow, and fosters creative destruction.

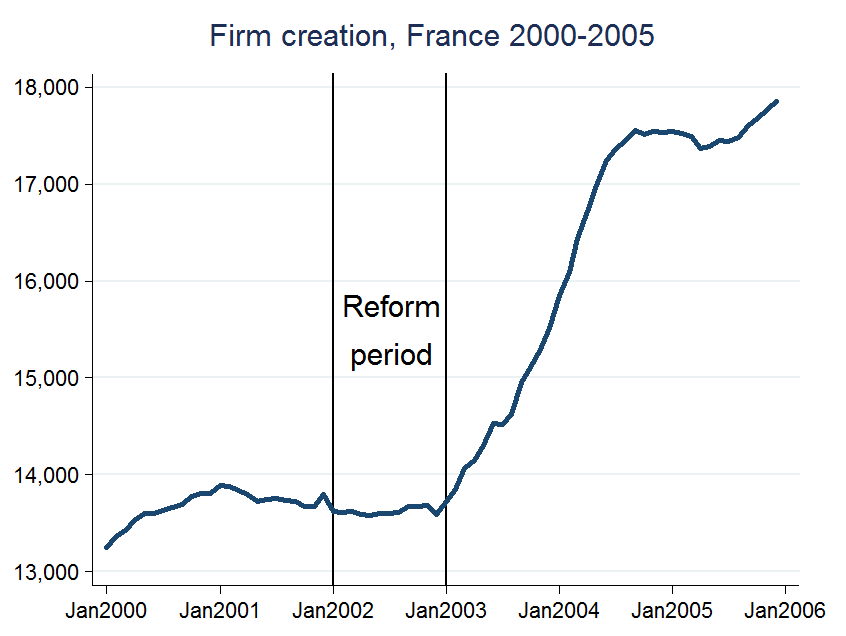

After a 2002 French reform made entrepreneurs eligible to unemployment benefits, business creation increased by 25%. We show that the reform did not decrease the average quality and growth rate of start-ups.

Anticompetitive Vertical Mergers Waves

with Jerome Pouyet and Nicolas Schutz

Journal of Industrial Economics, 2019

Vertical mergers that relax competition.

Can Innovation Help U.S. Manufacturing Firms Escape Import Competition from China?

with Adrien Matray

Journal of Finance, 2018

U.S. manufacturing firms that have invested in R&D are more resilient to trade shocks.

The Competitive Effect of a Bank Megamerger on Credit Supply

with Henri Fraisse and Mathias Le

Journal of Banking and Finance, 2018

A merger between two large European banks reduces credit supply to SMEs.

The Real Effects of Lending Relationships on Innovative Firms and Inventor Mobility

with Adrien Matray

Review of Financial Studies, 2017

Hurting lending relationships stiffles innovation and leads to reallocation of inventors across firms and across states.

News Trading and Speed

with Thierry Foucault and Ioanid Rosu

Journal of Finance, 2016

Traders who observe news faster than others have extremely volatile ("high-frequency") strategies.

Equilibrium Pricing and Trading Volume under Preference Uncertainty

with Bruno Biais and Pierre-Olivier Weill

Review of Economic Studies, 2014

Asset pricing when traders make decisions under preference uncertainty, because their financial firms face challenges collecting, processing, and disseminating information.

Overcoming Limits of Arbitrage: Theory and Evidence

with David Thesmar

Journal of Financial Economics, 2014

Arbitrageurs can choose their capital structure to take advantage of temporary mispricing: theory and evidence.

Upstream Competition between Vertically Integrated Firms

with Marc Bourreau, Jerome Pouyet and Nicolas Schutz

Journal of Industrial Economics, 2011

Competition between vertically integrated firms can fail.

Other Publications

Does Unemployment Insurance Change the Selection into Entrepreneurship?

with Antoinette Schoar, David Sraer and David Thesmar

NBER book Measuring Entrepreneurial Businesses: Current Knowledge and Challenges, 2017

Giving unemployment benefits to entrepreneurs does not deteriorate the success potential of start-ups.

Former PhD Students

Antoine Hubert de Fraisse (2025) London School of Economics (Finance)

Marina Traversa (2023) Leibniz Institute - SAFE (post-doc)

Chhavi Rastogi (2022) International Finance Corporation, World Bank

Noémie Pinardon-Touati (2022) University of Columbia (Economics)

Huan Tang (2020) London School of Economics (Finance) → Wharton (Finance)