April 21, 2020

Why is the price of oil futures negative at short maturities?

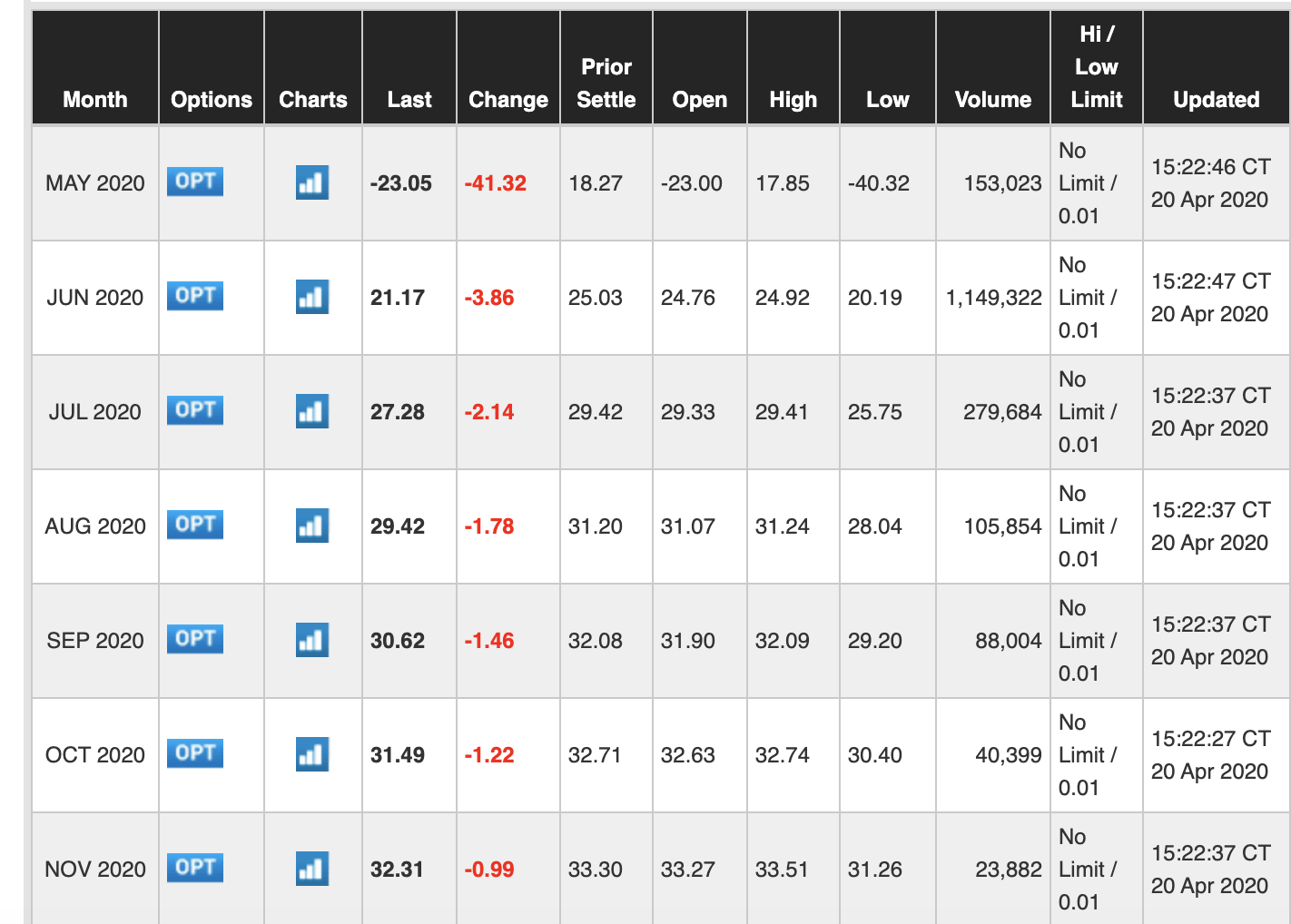

You probably heard that oil price is below zero for the first time in history. The screenshot below was sent to me by a student. The column "Last" shows the prices of futures oil contracts for several contract maturities. Remember that a futures contract calls for the delivery of the underlying asset (here: oil) at the maturity of the contract (May 2020, June 2020, etc.)

The amazing fact is that the contract for delivery in May has a negative price. It means that sellers are paying buyers for taking oil off their hands in May! But notice this is only true at short maturities: the June contract has a positive price as one would normally expect. How can we explain this pattern using what we learned in Financial Markets?

First, let us understand why the spot price of oil is negative. The spot price is the price for an immediate transaction. The current drop in economic activity and oil consumption leads to an oversupply of oil. At first, oil sellers can store oil but at some point they run out of storage capacity. At this point, they are ready to pay to give oil away: the spot price of oil becomes negative.

A futures contract with a short maturity must trade at a price very close to the spot price. This is most clearly illustrated in an extreme case. Consider a futures contract with delivery tomorrow. It is almost a spot transaction, so its price must be very close to the spot price. Conclusion: a futures contract with a close maturity date such as May 1st, 2020 has a negative price.

Ok, so we have an explanation for the negative price of the May contract. But why do contracts with maturity dates further away in the future such as June or July 2020 have positive prices? We need to remember the spot-forward parity applied to commodities. It tells us that the price of a futures contract is equal to

F(0,T) = (1+r)^T * (S(0)+C(0,T))

where

r = interest rate

T = maturity

S(0) = spot price

C(0,T) = cost of storing oil between today and time T

The marginal cost of storage is very high right now, because storage facilities are already running at full capacity: C(0,T) is very large. Therefore, even though the spot price S(0) is negative, the futures price F(0,T) can be positive. The economic intuition is that we are ready to pay a much higher price for oil delivered in June than for oil delivered tomorrow because it saves the cost of storage.

Update December 3rd, 2020: Les Echos reports that European oil majors implemented the arbitrage strategy studied in class that resulted from the low (even negative) oil spot price and the high oil futures price (Pétrole: les majors européennes sauvées par leurs opérations de trading). Oil majors purchased oil on the spot market and simultaneously sold oil futures contracts, stored oil and eventually delivered it through their short futures positions. Oil majors have a competitive advantage at implementing this arbitrage trade because they have storage capacities that other market participants lack.

Next post: Were stock prices too high before Covid-19? »

Home »