September 14, 2021

First published September 14, 2020

How central banks influence project valuation

The job of central banks is to stabilize the business cycle, trying to prevent unemployment to rise during recessions and keeping inflation in check during expansions.

To achieve these goals, the central bank sets the interest rate at which commercial banks borrow and lend money to each other. Because commercial banks are at the core of the financial system, the inter-bank interest rate determines the interest rate for businesses and households. The central bank therefore controls the interest rate in the economy.

The central bank stabilizes the business cycle by managing the interest rate

We learn in finance classes that an investment project should be carried out if its Net Present Value (NPV) is positive. The NPV is the present value of cash flow that the project is expected to generate net of the investment cost. Present value means that cash flow earned in the future is discounted back to the present. When the interest rate is lower, the discount rate is lower, and the present value of future cash flow is higher.

Therefore lowering the interest rate expands the set of projects that clear the positive NPV hurdle, which boosts corporate investment. It is this reasoning that leads central banks to lower the interest rate during recessions. Conversely, when the economy is booming and firms already invest a lot, central banks increase the interest rate to avoid excessive investment and inflation.

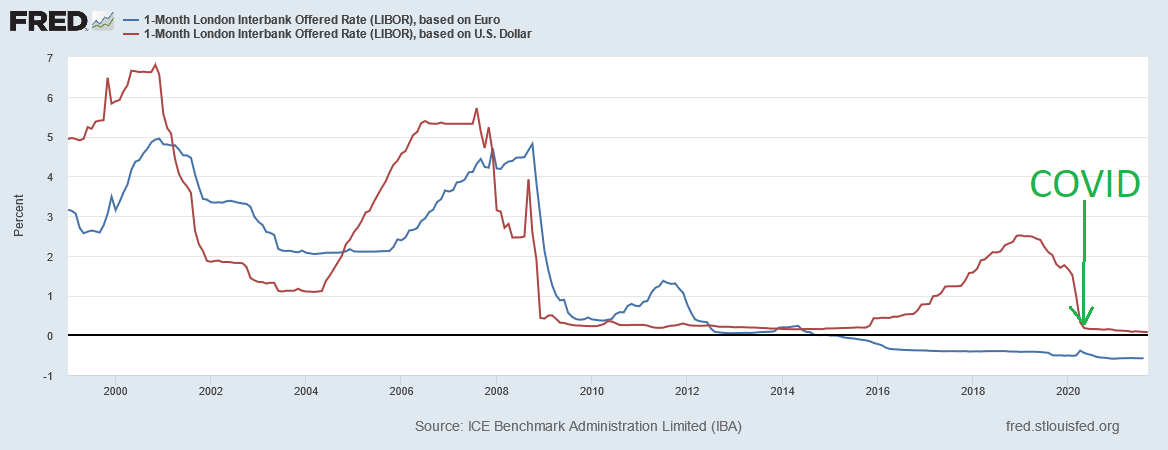

For example, the European Central Bank (ECB) and the US Federal Reserve (Fed) cut sharply interest rates in the 2008 Great Recession as shown in the graph at the top of the page.

In the COVID-19 crisis, the Fed cut again the interest rate. By contrast, in the Euro Area, the interest rate was already at zero and the ECB had no room to further lower it. But why not?

In the next post, we will see that central banks cannot lower the interest rate (much) below 0% — but that digital currencies may well change this state of affairs.

Previous post: How to value green investments (and eat chocolate)? »

Next post: Why interest rates don't go below zero — and why digital currencies can change it »

Home »