June 18, 2020

Covid increases debt owed to high-income people

Businesses and governments come out of the lockdown with high levels of debt. This is a source of worries because high corporate debt can create debt overhang and hinder corporate investment (see this post) and high government debt can lead to sovereign debt crises.

An aspect of the situation that is less discussed but crucial is where the debt is coming from. When a single country endures hard times, it often borrows from other countries. This logic does not apply to the Covid crisis because all countries were hit — we don't borrow from Martians (yet?). It must be that a group of people increased their savings during the crisis and lent money to other economic agents. Who is this group of people?

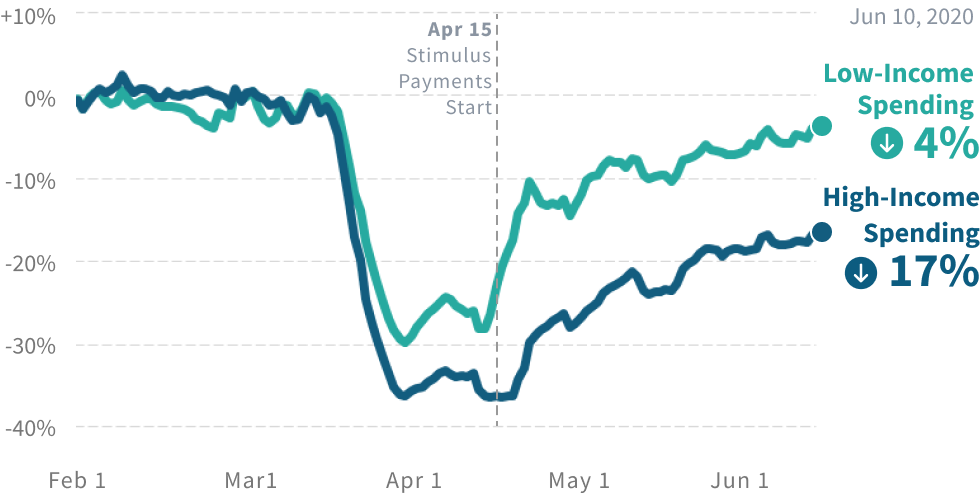

GDP fell dramatically during the crisis. Therefore, aggregate consumption also fell dramatically (everything that is consumed must be produced). But the fall in consumption is not uniform: high-income individuals reduced consumption significantly more than low-income individuals. The reason is that the lockdown reduced the operations of in-person services such restaurant, bars, hotels, clothing shops, etc. which are disproportionately consumed by high income individuals. The figure below tracks real-time spending by income group in the US: it shows that spending by high-income individuals drops significantly more than for low-income individuals (you can find many more real-time data on the US economy at https://tracktherecovery.org/).

At the same time, in-person service jobs are mostly held by low-skilled/low-income workers, who are therefore more likely to lose their jobs (in the US) or be put on partial unemployment (in Europe). By contrast, high-skilled/high-income workers are more able to work from home and keep their full salary. The combination of lower spending and maintained income leads high-income households to generate excess savings, deposited at the bank or in investment funds, and lent out.

The bottom line is that there is a flip side to the large increase in corporate and government debt: this debt is owed to households in the upper end of the income distribution. This fact is important for the evolution of wealth inequality. It is also important if (or when) debt is eventually restructured to know that ultimate creditors tend to be more affluent people.

Previous post: Should the EU issue perpetual bonds? »

Next post: How to deal with the coming wave of corporate bankruptcies? »

Home »