June 5, 2020

May inflation risk be higher than suggested by the bond market?

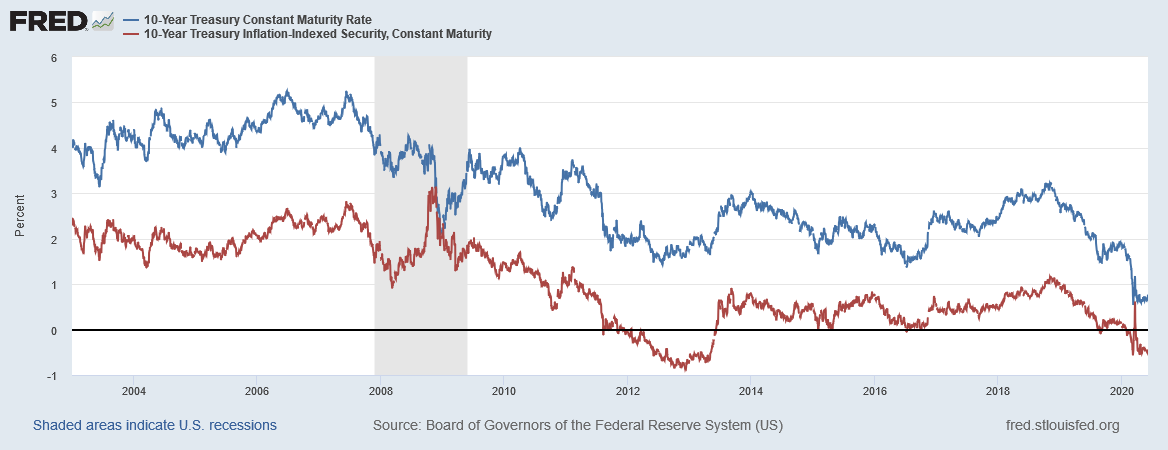

In the previous post we argued that bond prices point to expectations of low inflation. In the euro area, the difference between the yield on nominal bonds (subject to inflation risk) and the yield on inflation-indexed bonds (protected against inflation risk) is only 0.6%, which implies an expected inflation of 0.6% per year. In the US, the difference between the ten-year yield on nominal bonds (in blue on the figure below) and that on inflation-index bonds (in red) implies an expected inflation of 1.2% per year, which is also historically low.

Can these prices actually be misleading? This post reviews possible objections to the conclusion drawn from bond prices.

A first objection is that financial markets are not always informationally efficient, that is, security prices sometimes fail to reflect information about economic fundamentals. A classic example is the occurrence of stock market bubbles during which investors become overly optimistic about growth prospects. By the same token, one might argue that today's bond investors are overlooking inflation risk, leading to under-valuation of inflation-indexed bonds. The usual argument for market efficiency is that, if inflation-indexed bonds were obviously under-valued, savvy investors such as hedge funds would buy them, pushing up their price and the implied expected inflation rate. The counter-argument is that betting on inflation is risky even if inflation is a real possibility, because inflation is not for sure. In this case, arbitrage forces would no longer be at work and the price of inflation-indexed bonds may not reflect the true risk of inflation.

A second objection is credit risk. States of the world in which high inflation arises may also be states of the world in which governments default. Since coupons on inflation-indexed bonds would be much higher than coupon on nominal bonds in a scenario of high inflation, governments can be tempted to impose a higher haircut on (that is, to repay a lower fraction of) inflation-indexed bonds in the event of a sovereign default. In this case, inflation-indexed bonds would no longer be a hedge against high inflation. If bond investors believe this scenario is plausible, the price of inflation-indexed bond will not reflect their actual inflation expectations.

Data source: St. Louis Fed's FRED website is a great source for US macro economic and financial data.

Previous post: What does the bond market tell us about inflation risk? »

Next post: Should the EU issue perpetual bonds? »

Home »