May 25, 2020

Is the stock market disconnected from the real economy?

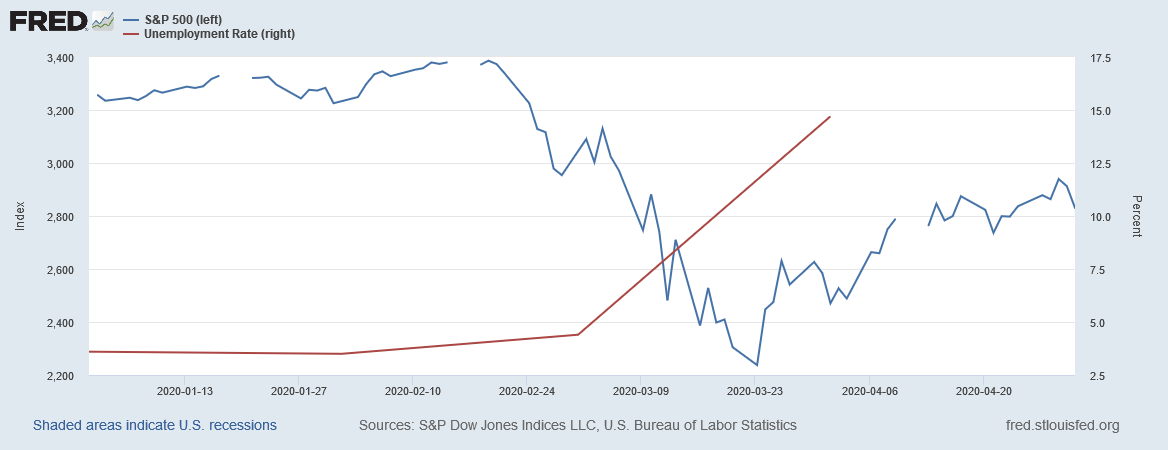

While unemployment is reaching levels not seen since the Great Depression and many small and large businesses are in dire financial situation, the stock market enjoyed very good returns over the past weeks. Is the stock market disconnected from the real economy?

The disconnect is only apparent. Several factors explain why stock prices can increase even though economic conditions deteriorate.

First and foremost, stock prices are forward looking. According to the Dividend Discount Model, stock prices are equal to the present value of current and future dividends. Current dividends are only a tiny fraction of total stock value. If the economy is currently doing poorly but expectations about the future improve, stock prices go up. This is arguably what we are experiencing right now. It is also important to keep in mind that stock prices are today still below their pre-crisis level despite the recent surge (this is the blue line on the graph).

Second, stock prices are equal to the present value of future dividends, that is, discounted dividends. The lower the discount rate, the higher the present value of future dividends. The discount rate for stocks is equal to the risk-free rate plus the equity risk premium. Since the beginning of the crisis, the risk-free rate has decreased by about one percentage point due to central bank intervention. Lower interest rates contribute to increasing stock prices.

A third, more debatable factor might be at play. Tech companies have been doing well during the crisis as everything was moving online. One might argue that the crisis has triggered a permanent shift to more online economic activity, which benefits tech giants more than (or perhaps, to the detriment of) the rest of the economy. Since tech giants are listed companies whereas small and medium-sized companies are not, profits of listed companies may grow faster in the future than profits in the rest of the economy. This last argument would point to a disconnect not between financial markets and the real economy, but between tech companies and the rest of the economy.

Previous post: Can social objectives be financed by money creation? Final part »

Next post: What does the bond market tell us about inflation risk? »

Home »