May 3, 2020

Why central banks purchase risky debt

Central banks massively intervened during the crisis. In particular, central banks engaged in large asset purchase programs (Federal Reserve enters new territory with support for risky debt, ECB predicted to beef up asset purchases with shift into junk bonds). What are these asset purchases and what are their goals?

In a crisis, central banks seek to lower interest rates. The rationale is that lower interest rates induce companies to invest and households to consume. Lower interest rates also reduce the cost of government deficits and mitigate the risk of a sovereign debt crisis. Before seeing how central banks can affect interest rates, it is important to remember that interest rates have two components:

Interest rate = Risk-free rate + Default premium

The risk-free rate is the interest rate at which you can borrow money when it is expected you will repay your debt for sure. But when creditors expect you may default on your debt with some probability, you will be charged a higher interest rate: the additional premium you must pay on top of the risk-free rate is called the default premium. The higher the risk of default, the higher the default premium. The default premium is also called the credit spread, so I will use both expressions interchangeably.

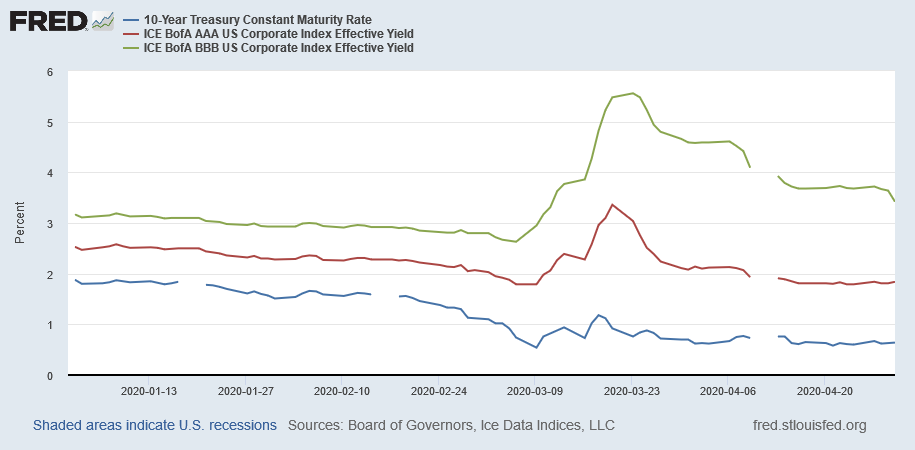

The figure shows the decomposition into the risk-free rate and credit spreads for the US credit market. The blue line at the bottom is the interest rate on Treasuries (bonds issued by the US government): this is the risk-free rate. The red line is the interest rate on bonds with low default risk (credit rating AAA), which are called investment grade bonds. The green line at the top is the interest rate on bonds with high default risk (credit rating BBB), which are called high yield bonds or junk bonds. The gap between the blue line and the other lines is the credit spread (default premium). Of course, the credit spread on BBB-rated bonds is larger than the credit spread on AAA-rated bonds.

We see that central banks can lower interest rates in two ways: reduce the risk-free rate and reduce credit spreads. Conventional monetary policy focuses on the risk-free rate (more precisely: the short-term risk-free rate). In practice, central banks control the risk-free interest rate by determining the interest rate at which commercial banks finance themselves, which in turn determines the interet rate at which commercial banks are willing to make non-risky loans to firms, households and governments.

During exceptional economic crises like the 2008 financial crisis and the Covid crisis, central banks also seek to reduce credit spreads. The rationale is that default premia charged to borrowers increase during a crisis, which further reduces investment and consumption and worsens economic problems. There exist two reasons why default premia increase during a crisis. The first one is that default risk increases. This is reflected in credit rating downgrades. The second reason is that the credit spread associated to a given level of credit risk increases. This is exactly what we see in the figure where the credit spread on BBB-rated bonds increases during the crisis.

The goal of central banks' asset purchases is to reduce the credit spread associated to a given credit rating. The idea is that of supply and demand. Think of the market for BBB-rated bonds. The "consumers" in this market are pension funds, insurance companies, mutual funds, etc. who buy the bonds. The "producers" are the companies who borrow money by issuing bonds. The credit spread is the price of default risk that equalizes supply and demand in the bond market. When more investors want to buy BBB-rated bonds, the relative scarcity of bonds increases and their price goes up, that is, the credit spread goes down.

This is exactly the purpose of central banks' asset purchases. By buying large quantities of bonds of a given credit rating, central banks seek to reduce the credit spread associated to this level of credit risk. It is the reason why, in the articles I point to at the beginning of this post, you see the US Fed buying risky debt and the ECB buying junk bonds (risky debt and junk bonds mean the same thing). The fact that credit spreads reverted in April after the March spike suggests that central banks' asset purchases have been effective.

Previous post: Why the equity risk premium has increased »

Next post: Debt overhang is looming: Is it curable? »

Home »